People lost everything and just walked away. In Houston, foreclosure starts after the floods from Hurricane Harvey spiked 76%. Now you know why so many properties are abandoned or foreclosed after flood damage. √ That glorious assistance will be about $5,000.Įxactly You get a loan of about $5,000 to cover an average of $40,000 to $90,000 in damage. √ If you get it, the assistance will be in the form of a loan you MUST pay back. √ The President must declare the area a disaster area to make federal assistance available. In order for you to get that government “assistance” all these pieces must fall into place: √ The Connecticut Governor must request a federal declaration of disaster. I’m from the Government, and I’m here to help. “The nine most terrifying words in the English language are: Ha! Government assistance after a flood is another lie. Right now you are saying “Yeah, but if you are such a Flood Nerd you know the government will step in and help”. It can cost $40,000 to $90,000 and that’s not even considering the damage to the contents of your home. Flooding is one of the most expensive causes of damage to repair. Buy flood insurance! Cover My Ass-ets with Flood Insurance Now What Happens When You Flood Without CT Flood Insurance? When your home is damaged by floodwaters and you don’t have a Connecticut flood insurance policy you must pay to repair the damage. Don’t buy the lie that low-risk equals no-risk. And 90% of people who had floodwater in their homes after these flooding events didn’t have flood insurance. This data shows that recent major storms cause flooding in low-risk areas. The government has been collecting flood data for the last 50 years.

But what about the next flood or the one after that? In Connecticut, a “low-risk” area isn’t a “no-risk” area. Maybe the flood of 2018 when 8 inches fell over the tri-state area didn’t affect you. Ever see a big storm coming and think about flooding? When the storm’s on the way, it’s too late to buy insurance. Did you think about buying flood insurance when you bought your house but said “If the lender doesn’t require it I must not need it”? Maybe the real estate agent told you it wasn’t necessary. That’s because 20% of all flooding events in the US every year happen in those “low risk” areas. Even areas of Connecticut considered to be low-risk areas are still at risk. And when it rains in Connecticut, it pours. Farmington, Putnam, Naugatuck, Waterbury, and Winsted were washed out. In 1955 back-to-back hurricanes inundated most of the state with rain. Then Kylie is calling from Connecticut for help. That’s unless there’s been a coastal storm or rain. It’s probably nothing, yeah, nothing at all” Ben Folds 2008 And they find out they’re wrong the hard way. Too many people think if they aren’t in a high-risk flood zone they don’t need coverage.

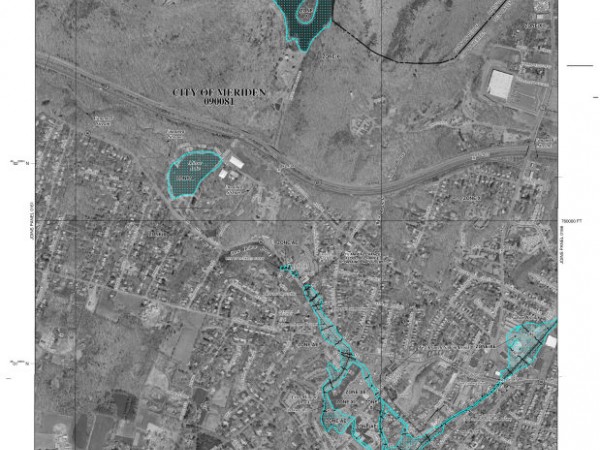

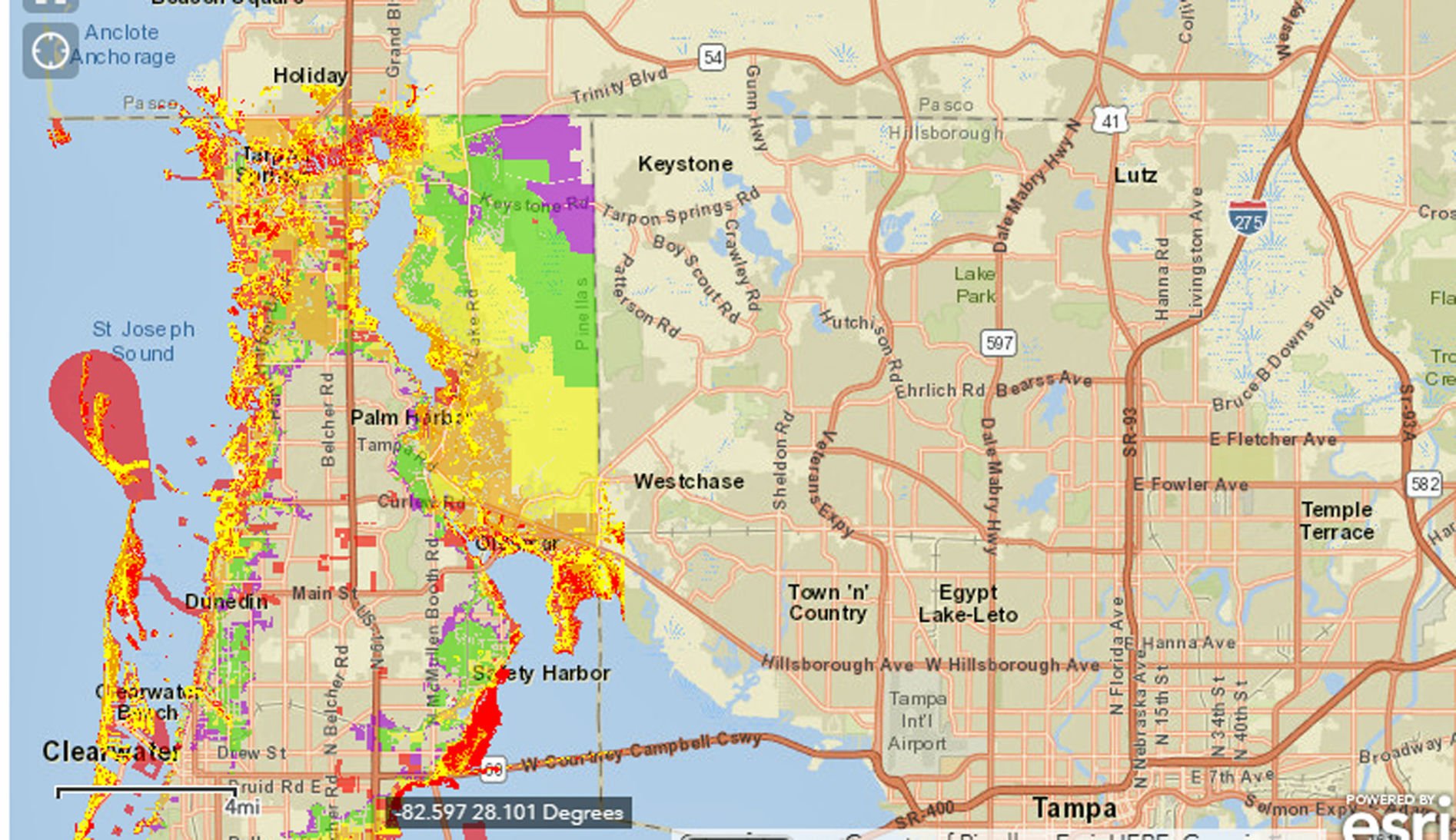

FLOOD ZONE MAP CONNECTICUT FREE

GETTING A QUOTE FOR CONNECTICUT FLOOD INSURANCE IS FREE Get a Free Quote for Connecticut Flood Insurance from a Flood Nerd Is CT Flood Insurance Really Necessary? If flood insurance is so necessary for Connecticut property owners shouldn’t homeowner’s policies provide it? No Way! The National Flood Insurance Program (NFIP) had a stranglehold on the flood insurance market for years. We know the Connecticut private flood insurance market like the back of our hand and we will always find you the best coverage and rate. The Flood Nerds are Connecticut Flood Insurance Experts.

FLOOD ZONE MAP CONNECTICUT HOW TO

That’s not how to save money on Connecticut flood insurance. Of the approximately 34,000 flood policies recently in effect in Connecticut, 32,000 of those were these Write Your Own policies that are just NFIP under a private logo. It’s easy for them but very expensive for you. And unfortunately, those Nationwide, Allstate, and other insurance agents will just stick you in the National Flood Insurance Program (NFIP).

To be protected against flood damage, you must purchase a separate flood insurance policy. Flooding is a serious risk in Connecticut.

Call your homeowner’s agent and ask them to add a flood endorsement to your policy. But they don’t cover the damage from flooding. These policies protect your home from things like fires, storms, and theft. Save Money on Flood Insurance Now Connecticut Homeowner’s Insurance Excludes Flooding A typical Connecticut homeowner’s policy is written through Traveler’s, Nationwide, Allstate, or State Farm. If you’re tired of increasing premiums or just need to get cheap flood insurance quickly, let the Flood Nerds find you the best coverage and price. Flood Nerds love to shop for flood insurance and we find historic savings on Connecticut flood insurance. Get a Quote Learn everything you need to know about saving money on Flood Insurance from the folks who know flood insurance best – the Flood Nerds Hi! I’m Robert Murphy, the Top Flood Nerd at Better Flood.

0 kommentar(er)

0 kommentar(er)